Pennsylvania: Screw Tax Credits, We Give Cash!

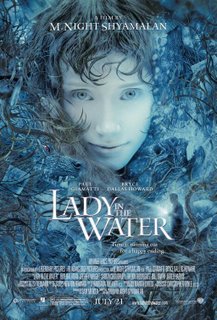

Is PA trying to insure its place in the film industry in case native son M. Night Shyamalan never works in its towns again? (Photo: Warner Bros.)

Just when we thought state film tax credits couldn't get any better, the Keystone State, home of the Amish and birthplace of the hoagie, went and one-upped us all: forget tax credits, said PA, we're giving out cold, hard cash. And I'm not talking about grants to starving local independent filmmakers, I'm talking about grants to the likes of the Walt Disney Company. Disney--ever the multimedia behemoth to pinch a penny--is first in line for one of these new grants. OK, so yes, the profit margins in the movie biz are generally thin, and it's a very risky business, but does that make it alright for state governments to hand out cash to for-profit entities?

PA's new cash grant program, effective 7/1/06 is called "Creativity in Focus: The Pennsylvania Film Production Grant Initiative" and provides up to 20% of a film or TV production's PA production expenditures. 60% of total production expenses must be incurred in Pennsylvania, and there is an overall annual cap of $10 million--so it's first-come, first-served.

I'm all for supporting the film industry, but just to keep this blog fair and balanced, let me leave you with some food for thought. An article in this month's fedgazette, a publication put out by the Federal Reserve Bank of Minneapolis, thoughtfully questions the true public value of film tax incentives. The article provides a good overview of arguments made for and against these incentives, concluding with a rather cynical point:

...states face a classic prisoner's dilemma. Here, two crime suspects interviewed separately are offered reduced sentences if each rats the other out; if both stay mum, they'll go free. But because they are separated, neither trusts the other to keep quiet—so each rats on the other in order to secure a lesser sentence, and ultimately both are worse off.

Incentives work the same way....If all states eliminated incentives, they would all be better off; films would still get made, and they would go to the most optimal locations, while states could focus scarce tax dollars on traditional public goods rather than on film incentives. But they're unable to do so because they can't trust other states to do the same, and doing nothing is even worse, because states lose economic activity to others offering incentives....those involved in perpetuating the rising costs of the incentive game say they have to play or they'll surely lose.

With that, I say, forget all those other piddling states and come shoot in Hawaii! We have some of the best tax incentives for film in the U.S.! Tee hee. (If you can't beat 'em, join 'em, etc.)

>> With eye on Pittsburgh, Disney applies for $2M state grant [Pittsburg Business Times, 7/24/06]

>> Creativity in Focus: The Pennsylvania Film Production Grant Initiative [PA Film Office]

>> Roll the credits ... and the tax incentives [fedgazette, September 2006]

RELATED POSTS:

>> Film Incentives That Aren't Tax Credits

>> More Film Tax Incentive Success Stories

>> Tax Incentives Suck...Who Said That?

>> Everyone Else Is Doing It...

>> States Cannibalizing States

>> Finally! Forms for 15-20% Film Tax Credit!