Rep. Karamatsu Issues News Release Supporting HB3080

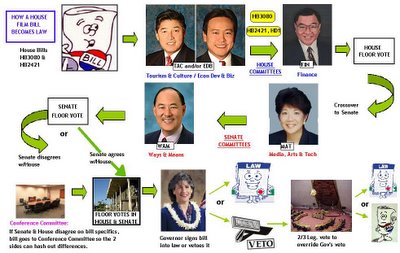

TAC passed HB3080 unamended and TAC/EDB passed HB2421 with slight technical amendments last week. Both bills are now awaiting a hearing by FIN.

Representative Jon Riki Karamatsu, chair of the House EDB committee, member of the TAC committee, and the second guy in the picture above, issued a news release announcing that HB3080, the 15-20% production tax credit, was passed out of TAC unamended last week. It is now awaiting a hearing by FIN. The bill was introduced by Karamatsu, along with fellow representatives Jerry Chang (TAC chair and first guy in pic above), Abinsay, Chong, Magaoay, Tsuji, and Yamashita. Below is the full news release:

###

THE HOUSE OF REPRESENTATIVES

State of Hawaii

News Release

For Immediate Release

February 6, 2005

Contact: Rep. Jon Riki Karamatsu

T. 808-586-8490

Media Assistance: Georgette Deemer

T. 808-586-6133; C. 808-341-5043

FILM TAX CREDIT BILL ADVANCES

Honolulu. Representative Jon Riki Karamatsu announced today that House Bill 3080 relating to tax credits for the digital media industry passed the House Tourism and Culture committee. Karamatsu, who serves as the chair of the House Economic Development and Business Concerns committee, introduced the bill.

"This bill is a collaborative refinement by state and county film offices, industry and union representatives of a similar bill that stalled in conference during the 2005 session, " said Karamatsu. "We wanted to offer significant, but reasonable incentives to stimulate the film and television industry, which experienced a $64 million drop in expenditures between 2004 and 2005."

The bill provides a tax credit amounting to 15 percent of qualified production costs incurred on Oahu, and 20 percent on Neighbor Islands, with a cap of $8 million per production. According to film industry officials, this would make Hawaii competitive with other jurisdictions.

"Hawaii has been called the world's premiere tropical location, " said Representative Jerry Chang, chair of the Tourism and Culture Committee. "If we want to maintain that position, the industry has told us that we must be more than just a pretty face. These tax incentives will help to grow the industry and provide well-paying, creative jobs for the next generation of Hawaii filmmakers."

The Department of Taxation submitted testimony in strong support of the measure, stating that the tax credit allows Hawaii to compete in the worldwide marketplace of filming locations and that it is budget neutral, meaning that the tax credit would not impact the state's current expenditures.

"The success of LOST in winning the Emmy, Golden Globe and Screen Actors Guild Awards has brought positive attention to the film industry in Hawaii. If we can seize the moment and compete with other localities around the world, we will generate revenue and create jobs for our community," added Karamatsu.

###

RELATED POSTS:

>> House Film Bills Make It Through Round 1

>> Summaries of Film Bills

>> Hawaii Film & TV Productions Goin' Down